About Warp Drive

In the dynamic realm of decentralized finance, Warp Drive emerges as a catalyst for innovation and community-driven progress. Built on the robust Arbitrum network, Warp Drive operates as a precision engine within a yield generation coalition, propelling the Curve Finance flywheel to new heights.

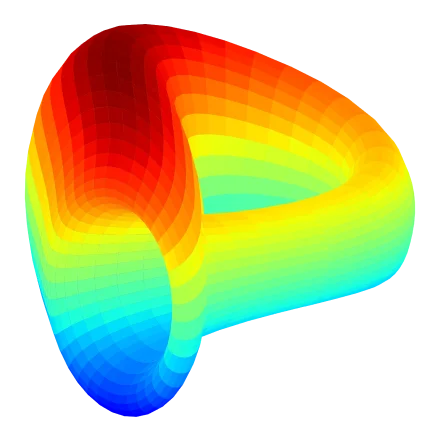

The RFI ENGINE

Warp Drive stands as the premier RFI token intricately built upon the Curve Finance infrastructure. Propelled by a unique engine, it strategically applies buy pressure on CRV, offering a lucrative and profitable venture for WARP holders through an innovative yield generation mechanism combined with deflationary tokenomics.

Overview

Explore the Financial Engine

Discover the inner workings of Warp Drive’s financial engine. With a total supply of 1 billion tokens, our unique 10% cumulative tax structure ensures every transaction contributes to the growth of the ecosystem. Allocations to token holders, the cvxCRV position, and burning mechanisms play crucial roles in the deflationary journey of Warp Drive.

Yield Generation Coalition

Revolutionizing Finance with Collaboration

Warp Drive pioneers the concept of a Tokenized Hedge Fund Coalition. Mirroring traditional hedge funds, our model channels a 4% tax towards a yield-generating asset. This innovative approach not only aligns with proven investment strategies but also amplifies returns for our community. Experience the synergy of financial ingenuity and decentralized collaboration.

Overview

Explore the Financial Engine

Discover the inner workings of Warp Drive’s financial engine. With a total supply of 1 billion tokens, our unique 10% cumulative tax structure ensures every transaction contributes to the growth of the ecosystem. Allocations to token holders, the cvxCRV position, and burning mechanisms play crucial roles in the deflationary journey of Warp Drive.

Yield Generation

Coalition

Revolutionizing Finance with Collaboration

Warp Drive pioneers the concept of a Tokenized Hedge Fund Coalition. Mirroring traditional hedge funds, our model channels a 4% tax towards a yield-generating asset. This innovative approach not only aligns with proven investment strategies but also amplifies returns for our community. Experience the synergy of financial ingenuity and decentralized collaboration.

Supply Distribution

Liquidity and Team

Warp Drive adopts a token supply distribution that allocates a mere 3% to the team, while directing a significant 97% to the liquidity pool. Notably minimal compared to industry standards, the team allocation emphasizes our dedication to fostering a decentralized environment, where each participant has equal opportunities for engagement and benefit.

Tax Distribution

Reflection, Strategy, and Burn Mechanism

Warp Drive employs a unique 10% cumulative tax structure, strategically allocated to foster sustainable growth. Of this, 4% benefits token holders, 4% bolsters the cvxCRV position, and 2% is earmarked for burning mechanisms. This transparent and strategic distribution is designed to maximize benefits for the coalition.

Project Strategy

A Strategy Centered on Sustainability

Warp Drive’s strategy revolves around sustainability and value creation. By compounding 70% of the monthly cvxCRV yield for sustained growth and using 30% for buyback and burn mechanisms, we actively reduce the token supply and increase its value. This innovative approach sets Warp Drive on a trajectory for long term success.

Fueling Growth with Precision

Warp Drive’s Yield Generation Cycle is a finely tuned mechanism designed for sustained growth and value enhancement. It commences with the collection of a 4% tax in WARP tokens from each transaction, initiating a process that ingeniously propels our ecosystem forward.

Buyback and Burn Mechanism

Simultaneously, 30% of the monthly yield is tactically sold for ETH. The obtained ETH is utilized to buy back WARP tokens from the market. These bought-back tokens are then permanently removed from circulation through a burn mechanism, actively reducing the overall token supply.

Security and Documentation

Audit

TBA soon after launch

Q1 2024

Official Warp Drive Whitepaper

Q4 2023

Join the Coalition

Become part of Warp Drive’s Tokenized Hedge Fund Coalition, a dedicated community committed to pooling resources and amplifying returns for its members. Connect with like-minded investors on our Discord channel and together, let’s propel the Curve Finance flywheel to unprecedented heights.